Talking Cash: The power of compound interest

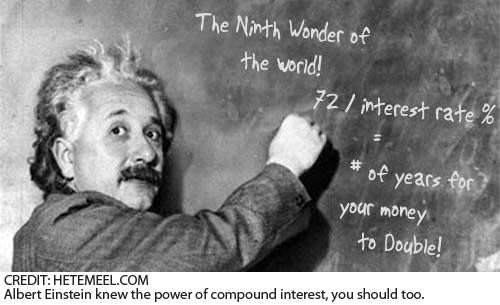

Albert Einstein once said, "The most powerful force in the universe is compound interest." In case you haven't heard, Einstein was a pretty smart guy. He knew what he was talking about when it came to ultra-geeky concepts such as the theory of general relativity. It turns out that he also knew what he was talking about when it came to personal finance.

Compound interest is an extremely powerful tool in finance. It's a tool that you could (and should) use to get rich. Financial geeks like me are already aware of this, but it's a concept that every person who wants to have more money (i.e. every single person) ought to understand.

Compound interest is simple, but awesome. When you earn interest on a principal amount, that interest is added to the principal. You then earn interest on both the principal and that previously earned interest. After that, all the interest you earn is paid on the principal and any previous interest you earned, so you are making interest on top of interest (on top of interest on top of interest on top of interest, etc.) for as long you keep the money invested. Simple, but awesome.

Understanding the fundamental concept of how compound interest works will greatly serve you when you begin to work and save money after you graduate. Once you're working, it's generally wise to start saving, be it for retirement, for a down payment on a home, for a car, whatever. I know it sounds like a lot of these things are many years off (who is thinking about retirement right after they graduate from Fanshawe?), but that's where the power of compound interest comes into play: the more time the interest has to compound, the more money you earn.

Time is money, man. It can be debt, too, though. Many financial experts advise that it is a good idea to focus on paying off debt before one focuses on saving. This is good advice. Compound interest also applies here. If you have credit card debt, for example, all the interest that accumulates is added to the principal, and then you pay interest on top of interest. This is where compound interest is a double- edged blade, because if you owe money, it's compounding. That means you want to eliminate your debt as quickly as possible, that way the power of compound interest doesn't have much time to kick into full effect.

Whether you're saving or paying down debt, it is the concept of compound interest that will help or hinder you. Understanding the very basics of how it works will assist you in managing your money. Calculating compound interest can be pretty difficult, but fortunately there are a number of online calculators where you can plug in your figures and get it all figured out for you. Moneychimp.com has a number of compound interest calculators that can help. A cursory Google search of the keywords 'compound interest' will also turn up a ton of results (although the quality of those results may vary, so you're warned).

Jeremy Wall is studying Professional Financial Services at Fanshawe College. He holds an Honour's Bachelor of Arts from the University of Western Ontario.